We have initiated this digitization program for kiranas to help them run their businesses more efficiently, enable more footfall, income and profitability for them, and ensure that they operate like any omni-channel store. He also added, “This in one hand will benefit both our customers and our employees, for whose loyalty and performance we are very grateful, and on the other hand will enable Metro to focus on accelerating growth in the remaining country portfolio.” The symbiotic relationship will create greater value for all stakeholders in the retail ecosystem. Non-trade cement is with reference to goods sold by the manufacturer directly to the consumer. Trade cement is sold by the manufacturer to the dealers, who in turn sell to the consumers.

As one of Europe’s most problematic banks, its struggles have far-reaching implications for the broader financial system, making it a critical issue for investors to monitor in the coming months. According to the expectancy model, it is not the relationship between spot and futures prices but that of expected spot and futures prices, which moves the market. This is why market participants would enter futures contract and price the futures based upon their estimates of the future spot prices of the underlying assets.

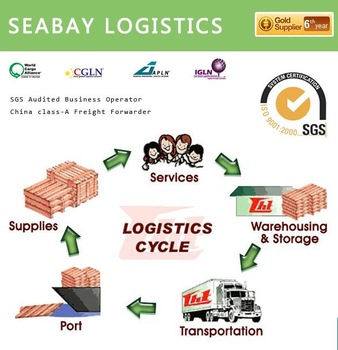

Our collection centers support the farmers in sustainable production of high-quality fruits and vegetables and help eliminate the process of a farmer’s produce being exchanged through many hands. We train our farmers in the adoption of new crop management techniques, optimum utilization of resources and agronomic practices. Suppliers of meat and fish are also trained in international quality and safety standards and certification systems. At METRO, cash and carry model we have played an active role in bringing efficiency and strengthening the agrarian fabric of the economy. We are addressing quality, trust and pricing issues through our direct sourcing from farm that has positively impacted over 5,000 farmers across the country. As part of our ‘Direct Farm’ program, we now have six collection centers in the state of Karnataka (Malur & Chikkaballapur), Telangana , Maharashtra , West Bengal , and Haryana .

Mark to market (M2M):

It is when the market is in contango that cash and carry arbitrage occurs. Due to future price varies everyday so initial margin also varies everyday each and every time A trader initiates A futures trade there are few financial intermediaries who work in the background making sure that the trade carries out smoothly. The two prominent financial intermediaries are the broker and the exchange. It is important for traders to regularly monitor their futures positions and to ensure that they have sufficient margin to cover any potential losses. If the margin balance falls below the required level, traders may be required to deposit additional funds or their positions may be liquidated to protect the exchange and other market participants. Extend the concept of cash and carry model by adding the inflows during the holding period of underlying assets.

A cash and carry transaction is a type of trade in the futures market where the price of a commodity is below the futures contract price. Cash and carry transactions are considered arbitrage, and take place either with cash or on the spot market. Since carry trades are often leveraged investments, the actual losses have been probably a lot larger. A cash and carry transaction is a kind of trade within the futures market where the price of a commodity is beneath the futures contract worth. Cash and carry transactions are thought of arbitrage, and take place both with money or on the spot market.

To take the advantage of this mis-pricing, an arbitrageur/ trader may borrow Rs 12,66,000 at an interest rate of 9% p.a. And buy 3000 shares of DHFL in cash market at Rs 422 and sell 1 lot of DHFL Futures contract at Rs 430. It is the buying or sale of a certain asset so as to benefit from the pricing difference of the asset in different markets.

The holy grail of the consumer business is to be able to anticipate these changes and respond to them with appropriate products and services. We are witnessing the rise of healthy and conscious consumption by consumers. With 65% of India below the age of 35, there is a move towards a healthy life that has created a new market for sports goods and sportswear in the urban cities. She also said, “We believe that Metro India’s healthy assets combined with our deep understanding of Indian merchant/kirana ecosystem will help offer a differentiated value proposition to small businesses in India.” “Demand in the trade segment, which usually refers to retail demand, is likely to remain muted.

Over the years, METRO has become a preferred partner for start-ups and regional brands to accelerate their business. We have been working with new-age food and tech start-ups, SMEs including women entrepreneurs, many of whom have now scaled up their operations from single city to multiple cities. A case in point is that of F-Gear – a brand started in 2004 by an enthusiastic entrepreneur Ruchi Jindal, who started the association with METRO as an exclusive brand.

Investment for all

Now that we are heading service, innovation, delivery and digital, there has been a strong word of mouth and resonance with the METRO brand. We have remained focused on our format and not get distracted with the noise around us. In case of natural disaster like flood in A particular region, people starts storing essentials commodities like grains, vegetables, and energy products etc. As A human tendency we store more than consumption requirement during crisis. If every persons behave like this then assets demand increase in cash market.

What is cash and carry model of future pricing?

Cash-and-carry arbitrage seeks to exploit pricing inefficiencies between spot and futures markets for an asset by going long in the spot market and opening a short on the futures contract. The idea is to ‘carry’ the asset for physical delivery until the expiry date for the futures contract.

Deutsche Bank, the largest lender in Germany, saw its shares tumble amid growing concerns over the global financial system. The bank’s stocks experienced their third consecutive day of losses, dropping by as much as 15 percent before making a slight recovery and ultimately closing down by 8.5 percent. Credit-default swaps, used to insure against the bank’s default, soared to levels not seen since 2020. Investors are growing increasingly concerned about institutions perceived as vulnerable, especially following the takeover of Credit Suisse by its larger and more stable rival, UBS Group.

Reliance Retail buys 100% stakes in Metro Cash for Rs. 2850 Cr

Traders secure a profit by taking a long position on the financial commodity and selling the corresponding futures contract. Now here is where the cash and carry arbitrage model is a slight advantage over traditional cash-futures arbitrage. Cash & carry arbitrage can happen when the price of an asset in the future is higher than the current cash market.

How does cash and carry work?

‘Cash-and-carry’ refers to a business model that virtually excludes all credit transactions, requiring up-front payment for all goods and services. Companies with a cash-and-carry business model eliminate accounts receivable from their books and are able to match all sales with actual cash receipts.

Therefore, arbitrage could also be more profitable, all else held fixed, in these non-bodily markets. Next, let us discuss the different market participants in this futures market. Reebok business in India to a cash-and-carry model to protect itself from further losses in operations. As a part of this exercise, the company has asked franchises to shift to the new terms and conditions latest by November.

It added that the multi-channel business-to-business cash and carry wholesaler has reach to over 3 million B2B customers in India, of which 1 million are frequently-buying customers, through its store network and eB2B app. “With Metro India, we are selling a growing and profitable wholesale business in a very dynamic market at the right time. We are convinced that in Reliance we have found a suitable partner who is willing and able to successfully lead Metro India into the future in this market environment,” said Steffen Greubel, the CEO of Metro AG. A basket is a group of stocks or mutual funds handpicked under a trending theme.

‘Cash-and-carry, we discovered, is a great model for us in India’

The first store takes time but it will come up next year and once that happens and the momentum starts, it can be very rapid as the pipeline is ready. There are many proposals in the pipeline right now and availability is not an issue. Update your mobile number & email Id with your stock broker/depository participant and receive OTP directly from depository on your email id and/or mobile number to create pledge.

- The margin requirement is set by the exchange where the futures contract is traded, and it serves as a performance bond that ensures that the trader has the necessary funds to cover any potential losses.

- In this case, the trader or arbitrageur would purchase the asset at $100, and simultaneously sell the one-month futures contract at $104.

- We believe Metro India’s healthy assets combined with our deep understanding of Indian merchant/kirana ecosystem will help offer a differentiated value proposition to small business in India,” said Isha Ambani, the director of RRVL.

- Cash and carry transactions are thought of arbitrage, and take place both with money or on the spot market.

The AAI’s action comes after it deferred a similar move when it placed SpiceJet on cash-and-carry basis from all its airports owing to pending dues from July 30. “GoAir is engaged in constructive discussions with AAI and would like to assure our customers that there is no impact on GoAir’s operations,” the company added in a statement. Reliance Retail Venture Limited has signed an agreement to acquire 100% stake in Metro Cash and Carry India Private Limited on December 22. Metro Cash and Carry India Private Limited is the part of German firm Metro AG operating in India. As an Added security measure to your account we need to verify your account details. We have received your acceptance to do payin of shares on your behalf in case there is net sell obligation.

The dealer would then carry the asset till the expiration date of the futures contract, and deliver it against the contract, thereby guaranteeing an arbitrage or threat-much less revenue of $2. Cash-and-Carry arbitrage positions usually are not 100% without dangers as there are still risks that carrying prices can increase, similar to a brokerage raising its margin charges. Cash-and-carry-arbitrage is amarket impartial technique combining the purchase of a protracted position in an asset such as a stock or commodity, and the sale of a place in a futures contract on that very same underlying asset.

The Company, with 3500 employees, is serving 30+ lakhs customers out of which 10+ lakhs are loyal customers. No not required because of initial margin made by two components span + exposure margin if money come less than span margin then we have required a deposit money if you don’t deposit then your broker will force the close position. Before closing position broker request to you via call, message, or email to pump margin money is also popularly called the “margin call” for continue position to fulfill margin call need.

Prevent Unauthorized Transactions in your demat / trading account Update your Mobile Number/ email Id with your stock broker / Depository Participant. The investor purchases the commodity at Rs.101, an effective long position. The arbitrageur also simultaneously sells the futures contract at $108.

What is a cash and carry model?

Cash and carry is a retail model where customers must pay for their items upfront at the point of sale system without using a store account, layaway, or another payment scheme where the merchant issues credit. The buyer then leaves the retail store with their goods.

The Client has read and understood the risks involved in investing in MUtural Fund Schemes. Your first installment will be deducted from ledger & subsequent from the bank. I agree to the processing of my personal information for personalized recommendations, personalized advertisements and any kind of remarketing/retargeting on other third party websites. Kindly update your email id with us to receive contract notes/various statements electronically to avoid any further inconvenience. Check your Securities /MF/ Bonds in the consolidated account statement issued by NSDL/CDSL every month. 24 years old Early Childhood (Pre-Primary School) Teacher Charlie from Cold Lake, has several hobbies and interests including music-keyboard, forex, investment, bitcoin, cryptocurrency and butterfly watching.

What is cash and carry model of future pricing?

Cash-and-carry arbitrage seeks to exploit pricing inefficiencies between spot and futures markets for an asset by going long in the spot market and opening a short on the futures contract. The idea is to ‘carry’ the asset for physical delivery until the expiry date for the futures contract.